AIOps as a Transformative Financial Solution

The emergence of fintech and neo-banks has increased the level of innovation across the financial services industry. Just a few years ago, banks considered their many physical branches as a competitive advantage over neo-banks, which did not have the advantage of close contact with customers.

Today, banks are redirecting the cost of maintaining these physical branches to digital, contactless banking services. Innovation is the law of the land, making the digital customer experience more important than ever before.

The open banking models are enabling traditional banks to partner with neo-banks rather than compete with them. Fintech brings new capabilities faster with an improved customer experience. Traditional banks, willing to partner with neo-banks, bring their brand value and their customers, cultivated over generations to the relationship. The new business model requires a new operational model to guarantee the customer service experience.

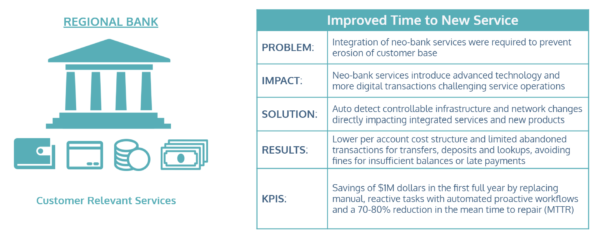

Based on key indicators, a large regional bank developed a transformation strategy where they would retain their core business, banking license, the customer database or CRM, and the compliance activity and rely on partners to bring new products based on fintech.

Market research indicated a need to enhance offerings to attract new customers – specifically loan consolidation and more small business services. These products would generate revenue, expand bank relationships, and in turn lower the per account cost structure. One characteristic of fintech is reliance on advanced technology.

By partnering with two neo-banks, this bank was able to offer loan products using artificial intelligence to grant credit in just ten minutes, as an example. Their strategy included an integrated way to offer current and new products to the customers using a branded platform with APIs linking to several specialized products developed by the partners. The bank began a systematic closure of branch offices, replacing high touch interactions with machine assisted transactions and contactless mobile services offered from the cloud.

To enable the business strategy, IT created a plan to prioritize the service experience – ensuring the bank’s ability to be out in front of any problems that would impact the customer and their transactions. The bank’s IT Operations team selected VIA AIOps. VIA AIOps provides total ecosystem observability used to discover service dependencies. VIA’s explainable AI would correlate events, incident, and change tickets to meet experience KPIs. As the bank moved to a more agile product delivery schedule, VIA AIOps offered the ability to manage changes without disrupting service.

On average, the bank projects a savings of $1M dollars in the first full year by replacing manual, reactive tasks with automated proactive workflows. The bank anticipates growth from introducing new digital services. By implementing the VIA AIOps solution, IT believes they will avoid hiring more engineers, originally scoped for the project, to manage changes. Based on data documented by other VIA clients, the bank anticipates that by automating 3 incident use cases the bank will see a 70-80% in mean time to repair (MTTR). Besides controlling the cost of acquiring talent, the bank expects to improve the customer service experience as measured by the Net Promoter Score (NPS). An important part of their brand campaign includes a consistent, safe, dependable customer experience for all new services. The bank is already experiencing unprecedented growth resulting from these new banking relationships and has been able to lower their per account cost structure. Limiting abandoned transactions for transfers, deposits and lookups is enabling customers to avoid fines for insufficient balances or late payments. Their improved service assurance has had a direct impact on their overall competitive position in the communities they serve.

0 Comments